According to news on July 14, Amazon European Site has upgraded tax compliance requirements for the Spanish market. It clearly stipulates that sellers involved in Spanish warehousing or participating in the Pan-European Program will be deemed non-compliant if they only hold a local tax identification number (NIF), and the EU tax identification number (ROI) has become a mandatory requirement. This move has attracted widespread attention from cross-border sellers.

Four categories of sellers must apply for ROI within 90 days: participants in the Pan-European Program, sellers with warehousing in Spain, sellers whose EU B2B orders account for more than 20% of total orders, and sellers newly expanding into the European market.

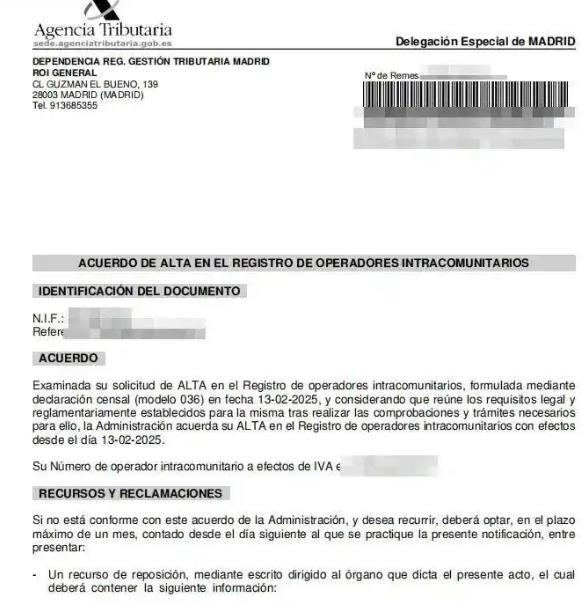

To apply, materials such as NIF and sales certificates are required, and procedures including Hague Apostille, electronic signature, and ECL declaration must be completed, with a processing cycle of 3-6 months.

After approval, sellers need to verify the validity of the tax identification number through the VIES system, reply to letters from the tax authority within 7 days, and standardize ECL declarations.

Question 1: What new tax compliance requirements has Amazon Spain put forward?

Answer: Amazon Spain clearly stipulates that sellers involved in Spanish warehousing or participating in the Pan-European Program will be deemed non-compliant if they only hold a local tax identification number (NIF), and the EU tax identification number (ROI) has become a mandatory requirement.

Question 2: Which sellers need to apply for the EU tax identification number (ROI) within the specified time? What is the application deadline?

Answer: The four categories of sellers that need to apply are participants in the Pan-European Program, sellers with warehousing in Spain, sellers whose EU B2B orders account for more than 20% of total orders, and sellers newly expanding into the European market. The application deadline is within 90 days.

Question 3: What procedures need to be completed to apply for the EU tax identification number (ROI)? What are the requirements after approval?

Answer: To apply, procedures including Hague Apostille, electronic signature, and ECL declaration must be completed, with a processing cycle of 3-6 months. After approval, sellers need to verify the validity of the tax identification number through the VIES system, reply to letters from the tax authority within 7 days, and standardize ECL declarations.